After a little over a year of being in charge, the growth that was promised in the run up to the election does not appear to have arrived as of yet. In, what many would argue, was a fairly obvious result of the budget in October, drastically raising taxes has not resulted in an increase in tax revenues and growth. I for one am shocked. Whilst I am hopeful that there can be some level of growth achieved over the second half of the year, it is hard to see where that is going to come from.

Estimates of job losses by the Guardian last month suggest that as many as 250,000 jobs have been lost since the budget. Much of this in entry level positions as the increased levels of employer National Insurance contributions and from £5,000 rather than £9,100 has started to bite. This coupled with the governments unwavering focus on Net Zero, which is estimated to cost over £800,000,000,000 by 2050 and has partly led to the highest industrial energy costs on the planet, has left many firms unwilling to pull the trigger on new investments. Coupling this with the new employee rights set to be introduced and it is obvious to see why innovation and business expansion is currently off the menu.

Whilst I do not disagree that employees should have a level of protection from the more unscrupulous employers, it does seem a bit punitive to give employees the right to sue there future employer from the their first day of employment. Whilst a FTSE 100 company will be able to afford the luxury of a well stocked HR department and the requisite policies to go with it, SME’s, which employ around 60% or the British workforce, do not have that luxury. This leaves business men and women in the unenviable position of having to somehow start and run a business during a period of high taxation, relatively high inflation, high employee cost and expensive energy. It is quite easy to see why someone who wants to start a business may actually decide to stick with the PAYE position and not take the risk. All these factors have a potential future loss of taxation to the exchequer as whilst many business’s do fail, many that succeed go on to make many millions and pay many millions in tax.

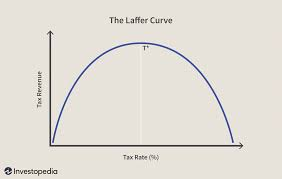

Now finally to come to the Laffer Curve which according to Wikipedia ‘illustrates a theoretical relationship between rates of taxation and the resulting levels of the government’s tax revenue, suggesting that there is an optimal tax rate that maximizes revenue’. Whether you think this is accurate or not is up for discussion, but we are seeing in real time that by raising levels of taxation on entrepreneurs and capital gains this has resulted in lower receipts. The most obvious reason for this being the reduction in the reward for the level of risk a person is willing to take. If you start chipping away at the reward structure, people naturally take less risk. Similarly if taxes are too high people will look at ways to avoid them, whether this is people making large pension contributions (not necessarily a bad thing), leaving money in a business rather than taking dividends or not starting that business altogether. Given it is the private sector that funds the public sector it is essential that the latter is thriving. If the private sector starts to struggle than that leaves public services in a bit of a quagmire.

The public finances by any estimate are not in a strong position. Regardless of political ideology something needs to be done to restore confidence, encourage wealth creation and facilitate growth and it is quite obvious that the tax rises last year have not had that effect. Given the next budget is only three months away, there will be some difficult levers for the Chancellor to pull, which ones they should pull will be the focus of many differing points of view and will also depend on who is sat in Number 11 come October.