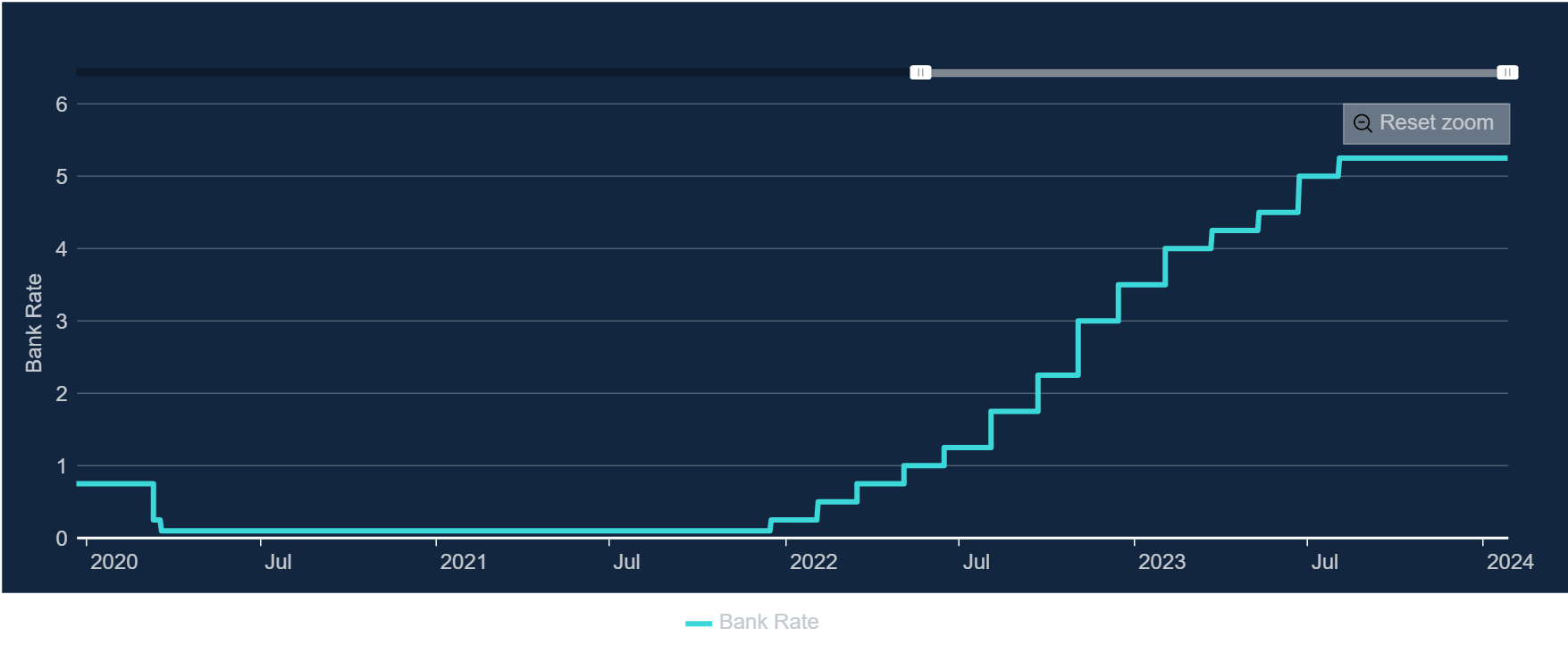

Unless you have been hidden in the Amazon rain forest, or perhaps achieved Elon Musk’s dream of building a colony on Mars, you can’t have failed to notice the rapid rise in interest rates over the last 18 months. With inflation raging like a toddler after a bad nights sleep, hiking interest rates was the most logical thing to do to try to get inflation back to a tolerable level.

Whilst his has been a hammer blow to mortgage holders it has been very handy for those with cash in the bank. Having had effectively no interest paid on savings since the great financial crash of 2008 it has been quite a good period for those with a healthy balance in a high interest savings account.

In terms of where it will all end, the consensus among the interest rate analysts is that they will start to come down sometime in the fourth quarter of this year. This will of course give mortgage holders a break from often cripplingly high monthly payments but will also means those with large cash balances will need to put their money to work elsewhere.

My personal view is that we are unlikely to see rates go down to near zero any time soon, or perhaps ever again. Whilst it was fantastic to be able to borrow money at a cost of next to nothing the longer term consequences of this has seen house prices sky rocket in the last decade leaving those without a deposit, or a helping hand from the bank of Mum and Dad, unable to get on the property ladder.

In short, if you are currently holding a mortgage with a high monthly payment, the pain should become more bearable sooner rather than later. Conversely if you have been enjoying a 5%+ per annum return from the safety of cash investments I think it makes a lot of sense to start planning to invest elsewhere as the free flowing 5% is likely to become more of a 2% trickle before too long.

If you are interested to know more about interest rates, please fill in your details below and one of our team will be in touch –