With the FTSE hitting new highs as of the 22nd April you would be forgiven for thinking the overall economy was absolutely booming. As we have seen in the quarterly growth numbers in the UK, the recovery since COVID has been slow and stuttering at best, with 0.1% growth per quarter being considered ‘success’.

As many forecasters have been saying for a while, are global investors finally starting to take notice of the cheaper UK stocks available (when compared to some of their US equivalents, think Exxon Vs. BP) or are there other factors at play?

Whilst we certainly cannot doubt that many of the FTSE 100 business’ are very competitive and well run one of their biggest benefits (arguably) is the fact that a good proportion of their profits are earned outside of the UK. According to the LSEG and estimate 80% of FTSE 100 companies revenues come from overseas.

This often means a good portion of their earnings come in USD which given its current strength against GBP leaves these overseas earnings worth more than they typically would be making exports more competitive notably in the service sector which has seen growth levels 9 times higher than than that of UK goods according to the FT

Overall it is certainly a good thing to see the FTSE 100 exceeding its all time highs however only time will tell if the economic recovery will continue and these all time highs will become a more regular thing in the coming 12-18 months. May be worth keeping the champagne on ice for now and see where the land lies towards the end of the year.

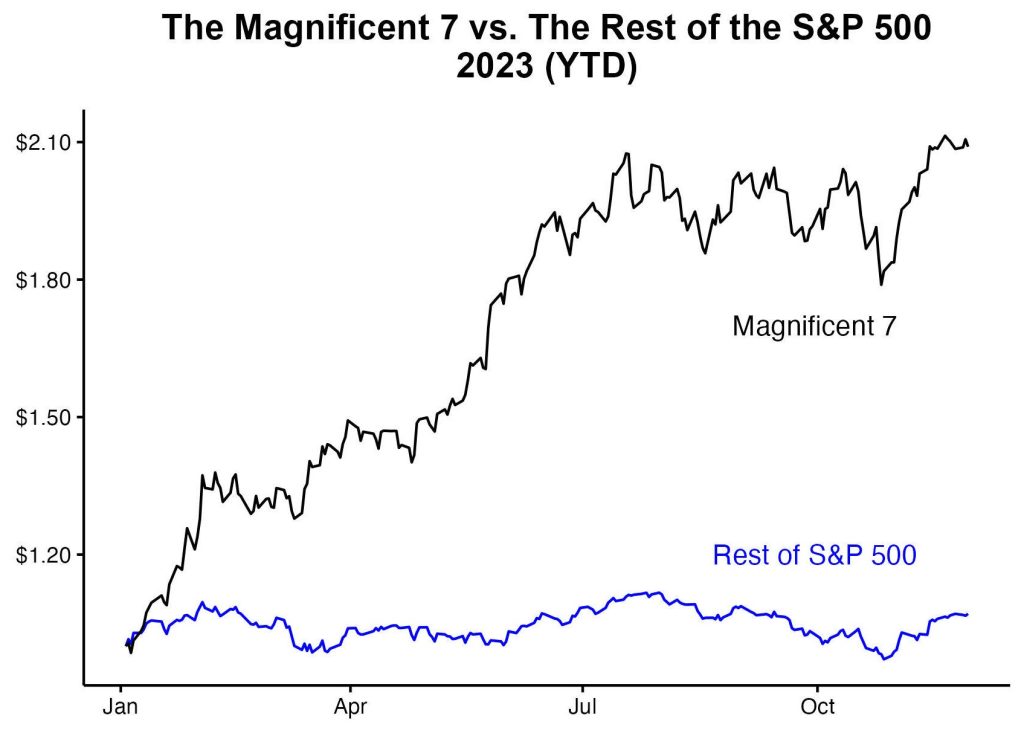

Investing in US stocks versus European stocks involves considering various factors, including economic conditions, market performance, regulatory environments, currency risk, and sector exposure. Here’s a comparison highlighting some key aspects of investing in each market:

Investing in US stocks versus European stocks involves considering various factors, including economic conditions, market performance, regulatory environments, currency risk, and sector exposure. Here’s a comparison highlighting some key aspects of investing in each market: