Many apologies for those of you looking for a film review on a classic Western film, I only post those on a Sunday afternoon. This post on the “The Magnificent Seven” refers to a concept in finance where seven mega-cap stocks, including Apple, Amazon, Microsoft, Facebook, Alphabet (Google), NVIDIA and Tesla, have had a significant impact on the performance of the S&P 500 index. These companies, with their dominant positions in various sectors such as technology, consumer services, and electric vehicles, have driven a substantial portion of the index’s gains in recent years.

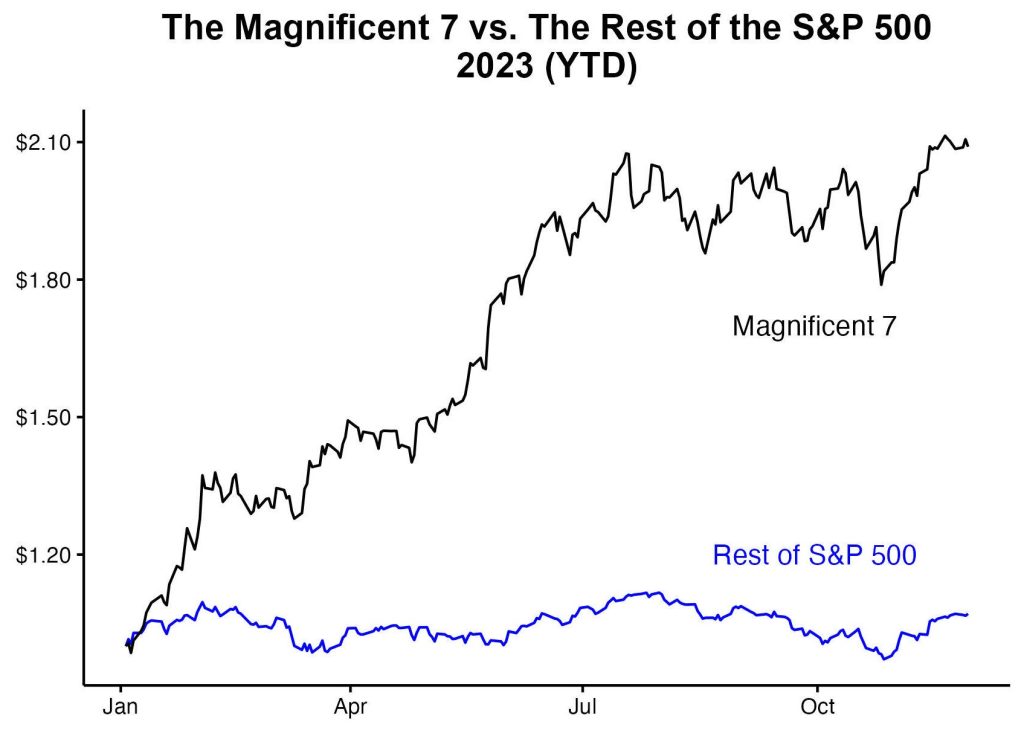

Here is a graph showing the Magnificent 7’s out sized performance relative to the rest of the S&P 500 in 2023 if you invested $1 in January 2023 –

Their influence on the S&P 500 can be seen in several ways:

- Market Capitalization: The combined market capitalization of these seven companies comprises a substantial portion of the total market capitalization of the S&P 500 index. As their stock prices rise, they have a disproportionate impact on the index’s performance.

- Index Performance: The performance of these companies often dictates the overall direction of the S&P 500. Strong earnings reports or innovative product launches from these companies can lead to significant gains in the index, while setbacks or negative news can trigger downturns.

- Investor Sentiment: Investor sentiment towards these seven companies often spills over into broader market sentiment. Positive news or performance from these companies can boost investor confidence, leading to increased buying activity across the market.

- Tech Dominance: As technology becomes increasingly integral to various aspects of modern life, the dominance of tech giants like Apple, Amazon, Microsoft, Facebook, Google, Netflix, and Tesla reinforces their influence on the broader market. Changes in consumer behavior, technological advancements, and regulatory developments affecting these companies can ripple through the entire market.

- Sectoral Weighting: Due to their substantial market capitalization, these companies have a significant weighting in sectors such as technology and consumer discretionary within the S&P 500. Consequently, fluctuations in their stock prices can impact the performance of these sectors and, by extension, the overall index.

Overall, the Magnificent Seven’s influence on the S&P 500 underscores the increasing concentration of market gains in a handful of large-cap stocks. While this concentration can amplify gains during bull markets, it also raises concerns about market volatility and systemic risks associated with the dependence on a select few companies. Investors and analysts closely monitor the performance of these companies as indicators of broader market trends and sentiment.

Overall it is clear that the primary stock market index in the US is quite heavily reliant on a relative handful of mega cap stocks that have been responsible for a huge amount of the returns over the last few years.

* This post is for informational purposes only and should not be used as a recommendation