Running With Bulls

With the S&P 500 hitting an all time high last week capping off a stellar six month period for the index, it does leave many wondering will the bull run continue.

In 2023, 62% of the S&P 500’s 26.29% total return was produced by what are referred to as “The Magnificent Seven” stocks – Amazon, Alphabet (Google), Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla. That is a very small band of stocks doing a gargantuan amount of heavy lifting. Whilst the largest of these stocks have a higher market cap than the GDP of the vast majority of countries, they still continue to add significant chunks of value to their share price. Most Western governments would give up most of their castles and national parks to have even a tenth of the levels of growth these companies can have in a year!

With a US election looming and the state of the economy inevitably linked to a Presidents electoral performance, I would think Biden and his team will do everything they can to continue the strong economic performance of 2023 and bring that momentum to November 2024.

My personal view is there will be a continuation of growth in the magnificent seven although not as strong as 2023. Historically, all-time highs follow more all-time highs. The S&P 500 averages a total return of 10.9% over the next year so whilst history can’t predict the future it is certainly a solid indicator.

Charting Your Financial Future

Tackling retirement anxieties requires understanding your current financial resources

Retirement is often seen as the golden phase of life, a period earmarked for relaxation and pursuing personal interests. However, a recent study has pointed towards an increasing trend of ‘retirement anxiety’, especially among individuals aged over 40[1]. Continue reading “Charting Your Financial Future”

Treasure trove

£26.6 billion in forgotten pensions

Did you know as many as 1 in 20 people could have a pension they didn’t think they had? Could that be you? It’s estimated £26.6 billion is currently trapped in forgotten pensions, averaging about £9,500 each[1]. With most individuals juggling multiple jobs throughout their lifetime, it’s no wonder that some of these pensions fall through the cracks. Whether due to a change of address or simple forgetfulness, these lost pensions could be the key to a more comfortable retirement.Search for lost pensions

Losing track of an old pension is easier than you think, especially if you’ve moved house and should have informed your old pension provider. But if you suspect that you have a lost pension, don’t despair. Start by reaching out to your previous pension provider. If you’re unsure who that might be, the government’s Pension Tracing Service can provide up-to-date contact details for your pension scheme. Tips on how to track down your lost pension: Begin by revisiting your CV or recalling every job you’ve held since leaving school or university. You may have had a workplace pension for each of these roles. Check any old pension statements you might have for details about your plans. The more information you can gather, the better.Connecting with your pension provider

If you remember the provider of your old pension, contact them first. When doing so, provide as much information as possible to aid in the search for your pension savings. This includes your plan number (if available), date of birth and National Insurance number.Utilising the Pension Tracing Service

If you believe you have a missing pension but lack information, turn to the government’s free Pension Tracing Service. Available on the gov.uk website or via phone at 0345 600 2537, this service can provide up-to-date contact details if you remember the name of your old employer or the pension company.Contacting the Pension Administrator

The Pension Tracing Service will only provide the contact details of the pension’s administrator. It’s then up to you to reach out and determine whether you have a pension and its current value.Verifying Your Pension Entitlement

Just because you have pension paperwork from a previous employer doesn’t necessarily mean you’re entitled to a pension. You may have received a refund of your contributions when you left the employer. Some older workplace pensions also required membership for a specific number of years before a pension entitlement was granted.Beware of scammers

Scammers often exploit legitimate events, so be vigilant around National Pension Tracing Day. Always ensure you’re communicating with legitimate entities.Keep track of your pensions

If you move house in the future, remember to inform your pension providers of your new address to avoid losing track of your pensions again.Time to track down your lost pensions?

Have you lost track of pensions from previous employers? Don’t let your hard-earned money go unclaimed. Remember, it’s your money, and you have every right to claim it. Let us discuss how we can help you start your search and secure your financial future! We look forward to hearing from you. Source data: [1] https://nationalpensiontracingday.co.uk/ A PENSION IS A LONG-TERM INVESTMENT NOT NORMALLY ACCESSIBLE UNTIL AGE 55 (57 FROM APRIL 2028 UNLESS THE PLAN HAS A PROTECTED PENSION AGE). THE VALUE OF YOUR INVESTMENTS (AND ANY INCOME FROM THEM) CAN GO DOWN AS WELL AS UP, WHICH WOULD HAVE AN IMPACT ON THE LEVEL OF PENSION BENEFITS AVAILABLE. YOUR PENSION INCOME COULD ALSO BE AFFECTED BY THE INTEREST RATES AT THE TIME YOU TAKE YOUR BENEFITS.Interested in Interest Rates?

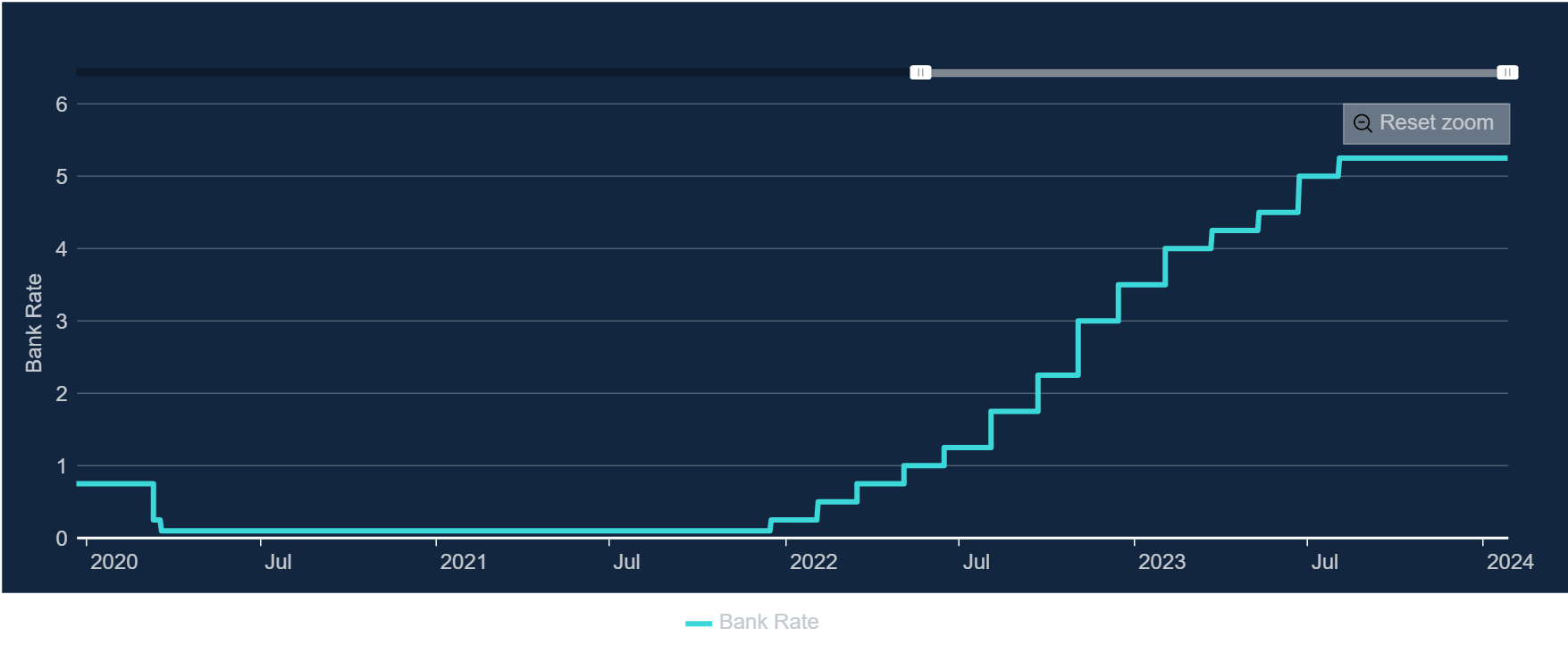

Unless you have been hidden in the Amazon rain forest, or perhaps achieved Elon Musk’s dream of building a colony on Mars, you can’t have failed to notice the rapid rise in interest rates over the last 18 months. With inflation raging like a toddler after a bad nights sleep, hiking interest rates was the most logical thing to do to try to get inflation back to a tolerable level.

Whilst his has been a hammer blow to mortgage holders it has been very handy for those with cash in the bank. Having had effectively no interest paid on savings since the great financial crash of 2008 it has been quite a good period for those with a healthy balance in a high interest savings account.

In terms of where it will all end, the consensus among the interest rate analysts is that they will start to come down sometime in the fourth quarter of this year. This will of course give mortgage holders a break from often cripplingly high monthly payments but will also means those with large cash balances will need to put their money to work elsewhere.

My personal view is that we are unlikely to see rates go down to near zero any time soon, or perhaps ever again. Whilst it was fantastic to be able to borrow money at a cost of next to nothing the longer term consequences of this has seen house prices sky rocket in the last decade leaving those without a deposit, or a helping hand from the bank of Mum and Dad, unable to get on the property ladder.

In short, if you are currently holding a mortgage with a high monthly payment, the pain should become more bearable sooner rather than later. Conversely if you have been enjoying a 5%+ per annum return from the safety of cash investments I think it makes a lot of sense to start planning to invest elsewhere as the free flowing 5% is likely to become more of a 2% trickle before too long.

If you are interested to know more about interest rates, please fill in your details below and one of our team will be in touch –

Investing After Retirement

Preserving wealth for your future lifestyle

After a lifetime of hard work, you’ve successfully built a substantial and comfortable retirement account. Congratulations are in order. You’ve officially entered the golden years of retirement! Now, it’s time to enjoy the fruits of your labour, provided you’ve laid the groundwork for a well-prepared retirement. But investing after retirement is quite distinct from accumulating wealth during your working years. The approach of steadily building your investment portfolio, benefiting from pound cost averaging and return compounding, worked well during your earning years. A low-maintenance ‘set and forget’ strategy, with occasional rebalancing, might have been all you needed. But when you retire, the investment dynamics change.Don’t underestimate your lifespan

Entering retirement might bring a sense of accomplishment but can also usher in doubts. You might question whether you’ve amassed enough resources, how to optimise them, and what to do if unforeseen circumstances arise. If you’re transitioning out of work entirely, you may experience a significant shift in perspective. It can be psychologically challenging to watch your net worth decrease after a lifetime of seeing it grow. Planning ahead can alleviate this stress. Begin by defining your financial goals and estimating their costs. Additionally, don’t underestimate your lifespan. The average life expectancy in the UK during 2023 was 81.77, but if you’re in good health in your sixties, you will likely live longer[1].‘Necessary expenditures’ and ‘desired expenditures’

This will likely involve distinguishing between ‘necessary expenditures’ and ‘desired expenditures.’ Compare these projected expenses against your known income sources—state and defined benefits pensions, any annuities due—to determine how much your personal pensions, capital, and investments need to generate to cover any deficit. In your retirement income strategy, you’ll encounter three major risks: inflation, longevity, and market volatility. Each requires a unique solution. Inflation silently erodes your spending power annually as prices rise. This has become particularly noticeable recently with the sharp increase in the cost of living after a period of relatively low inflation. However, even minor annual increases can compound into substantial hikes over the two decades or so that the average person spends in retirement.Two principal courses of action to consider

Market fluctuations are an ever-present uncertainty. While risk-taking can yield rewards over the long term, significant swings in a retirement portfolio’s value can be unsettling and potentially catastrophic if withdrawals coincide with market downswings in the early retirement years. Regarding retirement, your pension options are not solely about investing. You can take two principal courses of action as you approach this phase of your life. You can either continue investing and withdraw money from your pot as needed, a strategy known as pension drawdown, or purchase an annuity, an insurance policy ensuring a steady income for life.Challenging endeavour filled with numerous pitfalls

Pension drawdown provides additional flexibility and the potential for higher returns and increased income from your pension pot. Since your pension fund remains invested, market performance can fluctuate. Purchasing an annuity guarantees you a regular income that will last throughout your lifetime. Moreover, annuity rates have increased over the past year due to the rise in interest rates. Securing a steady income for 30 or so years can be a challenging endeavour filled with numerous pitfalls when drawing from an investment portfolio; the long-term average return and the sequence of returns matter. Poor performance in the initial years can also be costly, even if followed by good returns.Pension investment strategy aligned with your needs

While it’s crucial not to take too little investment risk, de-risking a portfolio might not be the best move if you only need to draw modestly on your money and keep most of it invested for long-term returns. However, withdrawing from your pot means you can benefit less from compounding returns. Ensuring your pension investment strategy aligns with your needs is essential as you approach retirement. Depending on whether you opt for an annuity or a drawdown, you might need to adjust the asset mix in your portfolio to meet your retirement objectives. Source data: [1] https://www.macrotrends.net/countries/GBR/united-kingdom/life-expectancy THIS ARTICLE DOES NOT CONSTITUTE TAX OR LEGAL ADVICE AND SHOULD NOT BE RELIED UPON AS SUCH. TAX TREATMENT DEPENDS ON THE INDIVIDUAL CIRCUMSTANCES OF EACH CLIENT AND MAY BE SUBJECT TO CHANGE IN THE FUTURE. FOR GUIDANCE, SEEK PROFESSIONAL ADVICE. THE VALUE OF YOUR INVESTMENTS CAN GO DOWN AS WELL AS UP, SO YOU COULD GET BACK LESS THAN YOU INVESTED.Making The Most of the Annual Allowance

With an election inevitably on the horizon and with that a likely change of government it is essential for people to make the most of the generous (in my opinion!) annual pension allowance available to them.

Jeremy Hunt surprised many in the pensions world by getting rid of the lifetime allowance altogether and upping the maximum annual pension contribution to £60,000 in the budget of last year. This change was very much unexpected and unsurprisingly wasn’t met with applause from the Labour party. A seeming pensions giveaway to those who already have the ability to have a large pension!

With a Labour election victory seeming very likely in the coming 12 months or so it is essential for anyone who has the ability to to make the most of these pension allowances whilst they are available.

Whilst it may not be top of Keir Starmer’s list of things to do should he take the keys to Number 10, it does seem very likely that lifetime allowance rules will be changed and the annual allowance reduced to previous or perhaps even lower levels.

With that in mind and with only a little over 10 weeks until the new tax year I would implore people to take advantage of the allowances whilst they can as by April 6th 2025 I very much doubt they will still be there.

Check our our LinkedIn

Private Sector Positivity

Great article below from AJ Bell –

The UK’s private sector expansion was stronger than anticipated at the start of 2024, preliminary data suggested on Wednesday, though the Red Sea crisis is showing early signs of reigniting inflationary pressures.

The S&P Global flash composite purchasing managers’ index rose to a seven-month high of 52.5 points in January, from 52.1 in December. Rising further about the 50-point no-change mark, it shows the pace of expansion sped up slightly. The reading was higher than FXStreet-cited market consensus of 52.2.

The expansion was solely down to growth within the services sector, as the services flash PMI rose to an eight-month high of 53.8 from 53.4, and came above FXStreet-cited market consensus of 53.2.

Manufacturing remained in sub-50 contraction territory with a flash PMI of 47.3, though the reading was nine-month high, and above 46.2 the prior month. However, production fell at the fastest pace since last October, amid weak order books and overstocked customers.

‘The latest survey also indicated a return of modest private sector employment growth at the start of 2024, supported by improving demand conditions and higher levels of optimism towards the business outlook,’ S&P Global said.

However, private sector firms saw the sharpest rise in input costs since last August, led by cost pressures within UK factories. Firms often remarked on higher freight costs stemming from the Red Sea crisis, while associated shipping delays caused suppliers’ delivery times to extend for the first time in a year. It was also the greatest rise in delivery times since September 2022.

Service providers also noted a steep rise in input costs, stemming from rising wages. However, the rise was the weakest in three months, leading to a softer rise in output pricing. Overall, prices increased at the weakest pace since last October.

‘The survey data point to the economy growing at a quarterly rate of 0.2% after a flat fourth quarter, therefore skirting recession and showing signs of renewed momentum,’ said Chris Williamson, chief business economist at S&P Global Market Intelligence.

‘Businesses have also become more optimistic about the year ahead, with confidence rebounding to its highest since last May. Business activity and confidence are being in part driven by hopes of faster economic growth in 2024, in turn linked to the prospect of falling inflation and commensurately lower interest rates,’ he added.

However, Williamson commented that January’s more-robust-than-expected growth could deter the Bank of England from cutting interest rates as soon as many are expecting. The BoE will also be paying attention to the inflationary pressures stemming from the Red Sea crisis, he added.

‘The longer journey times lifting factory costs at a time of still-elevated price pressures in the service sector. Inflation is therefore indicated to remain stubbornly higher in the 3-4% range in the near future,’ Williamson concluded.

The flash PMIs are compiled by S&P Global from responses to surveys sent out to around 650 manufacturers and 650 service providers in the UK. Responses are collected in the second half of the month.

The Forgotten Task On Britons’ To-Do List

Financial pitfalls that could have been easily avoided

Managing retirement plans and paperwork can seem daunting in our fast-paced, constantly evolving world. Yet, it’s an essential chore that should not be pushed aside. Not staying up-to-date with your retirement plans can result in financial pitfalls that could have been easily avoided. But worryingly, according to new research, 32% of Britons place pension administration at the bottom of their to-do list, even ranking it below managing hair and beauty appointments or planning holidays[1]. Interestingly, more than a fifth (22%) of pension savers confess that they fail to check their pension annually, not due to apathy but because they are uncertain about the process. An additional one in seven need help finding their pension information.Pension engagement season is a time for a rethink

As Pension Engagement Season gears up, it is concerning to note that pensions rank last on Britons’ ‘life admin’ to-do lists. This is despite pensions’ crucial role in shaping people’s financial futures. The task of managing personal appointments with hairdressers or beauticians takes precedence over pension paperwork for 25% of respondents. Meanwhile, 18% prioritise planning holidays over reviewing their pension plans. When consumers finally tackle pension administration, the research reveals that 27% only check their pension once a year or less frequently. Alarmingly, 14% confess to never having inspected their pensions.Knowledge gap is a barrier to pension management

Among those who do not check their account at least annually, a fifth (22%) admit that they refrain from doing so simply because they lack knowledge about the process. This percentage escalates to a third (34%) among 35 – 54 year-olds, compared to 26% of 18 – 34 year-olds and 11% of over 55s. A total of 16% of those who infrequently check their pension claim that they do not know where to access the information. Furthermore, 15% confess that they don’t know how to check it, while 13% feel their savings are too meagre to warrant engagement with their pension. Additionally, 12% avoid reviewing their pensions because they find the process overwhelming.Understanding your current pension status

It’s not uncommon for many of us to be in the dark about the exact amount we’ve saved up in our current pension plan. However, it’s crucial to clearly understand your savings as this can reveal gaps between what you already have and what you might need for a comfortable retirement. Your review should consider everyday expenses, occasional splurges like gifts and holidays, large purchases, and an emergency fund for unexpected costs. Remember to include any pensions from former employers or personal plans in your assessment. If you suspect that you’ve misplaced some pension information over time, the Government’s pension tracker website is a resource that could help.Leveraging workplace pensions

In today’s economic climate, short-term spending needs may take precedence. Nevertheless, when presented with an opportunity to join a workplace pension scheme, it’s generally advisable to seize it. Most employers must auto-enrol their employees into a workplace pension scheme, but you might still be offered a pension plan even if you’re not eligible for auto-enrolment. Workplace pension schemes comprise your contributions (5% or more of earnings), deducted directly from your salary before tax, and your employer’s contribution, which must be at least 3% of your earnings. Many employers offer to match your additional payments, so ensuring you’re maximising this benefit is worthwhile.Regular reviews of your pension investments are essential

Consider upping your pension contributions. Even small, regular monthly payments can accumulate significantly over time, thanks to the power of compounding. Also, contemplate making one-off payments into your pension, such as when you receive a work bonus or an inheritance. Life is ever-changing, and your retirement plans should adapt accordingly. Your envisioned retirement age may have shifted, or your financial circumstances may have evolved. It’s important to note that you don’t have to wait until the state pension age (currently 66) to access your workplace or private pensions. You can typically begin drawing from these at age 55, although this will increase to 57 from 2028. However, accessing your pension benefits early could restrict future savings and leave you with a smaller retirement income. Furthermore, your investment choices when establishing your plan may need to be revised. Regular reviews of your pension investments are essential to ensure they continue to align with your goals.Diversifying your investments over time

Pension savings, being invested funds, can fluctuate in value. However, these fluctuations shouldn’t cause undue worry. Remember, pensions are long-term investments that usually yield better returns over extended periods than traditional savings accounts. To mitigate the risk of significant fluctuations, consider diversifying your portfolio by investing in various asset types. Most workplace default investment options already provide this diversification, and many personal pensions offer packaged investment options for those who prefer to avoid building their portfolios.Simplifying your retirement and consolidating pension plans

Pension administration can prove challenging, especially if you’ve accumulated several plans over the years from different jobs. Consolidating these into one plan can streamline your paperwork, provide a clearer view of your overall pension value, simplify investment tracking, and potentially reduce charges. However, consolidation is only suitable for some. There’s no guarantee of a better pension plan through consolidation, and you might lose valuable benefits or guarantees from other plans. Thus, seeking advice before consolidation is crucial. Source data: [1] Research conducted amongst 2,000 UK adults on behalf of Standard Life by Opinium from 29th August – 1st September 2023. THIS ARTICLE DOES NOT CONSTITUTE TAX OR LEGAL ADVICE AND SHOULD NOT BE RELIED UPON AS SUCH. TAX TREATMENT DEPENDS ON THE INDIVIDUAL CIRCUMSTANCES OF EACH CLIENT AND MAY BE SUBJECT TO CHANGE IN THE FUTURE. FOR GUIDANCE, SEEK PROFESSIONAL ADVICE. A PENSION IS A LONG-TERM INVESTMENT NOT NORMALLY ACCESSIBLE UNTIL AGE 55 (57 FROM APRIL 2028 UNLESS THE PLAN HAS A PROTECTED PENSION AGE). THE VALUE OF YOUR INVESTMENTS (AND ANY INCOME FROM THEM) CAN GO DOWN AS WELL AS UP, WHICH WOULD HAVE AN IMPACT ON THE LEVEL OF PENSION BENEFITS AVAILABLE. YOUR PENSION INCOME COULD ALSO BE AFFECTED BY THE INTEREST RATES AT THE TIME YOU TAKE YOUR BENEFITS.